Updated April 1, 2024

Mike Zaccardi, CFA, CMT

Macro Money Monitor

Market Update

Words of Wall Street wisdom say to “never short a dull market.” Well, last week was among the quietest in recent memory. Cut short by Good Friday, an NYSE holiday, the S&P 500 rose a modest 0.4%. With a 10.6% total return through March, it was the best first-quarter performance since 2019 for the US large-cap index. The Nasdaq Composite gave back a bit of ground. Despite AI euphoria and so much ink having been spilled early in 2024 around the Magnificent Seven’s allure, the tech-heavy index underperformed the SPX.

Scanning the sectors, the unexciting Utilities niche posted a 2.8% advance – the strongest among the 11 S&P 500 groups. Real Estate, a major laggard of late, was also up more than 2%. Energy continued its winning ways, rising 2.2% during the holiday-shortened week, and eclipsing the Communication Services sector for the best sector return in Q1. The oil and gas area surged more than 10% in March alone as the equity rally broadened. Bringing up the rear to close out March were Comm Services and Information Technology – the only two sectors to underperform the S&P 500 for the week. Elsewhere, small caps finished at another fresh 2-year high, rising more than 2%, while foreign stocks eked out a slight advance.

The bond market was crickets, too. The US 10-year Treasury note yield was virtually unchanged, though the big data point of the week, PCE inflation, was released when markets were closed on Good Friday. Futures markets were also shuttered, so market watchers couldn’t get clues on how traders reacted to the data. The commodities arena was all bulled up to finish up the month. The S&P GSCI Commodity Index rallied 2.5% with the price of an ounce of gold soaring to more all-time highs. Oil, now above $83 on WTI, settled Thursday at its highest mark in five months. The meme of the week in commodities was cocoa futures – it’s now more expensive to procure a ton of cocoa than copper.

Source: Stockcharts.com

The Look Ahead

It’s time to hop back into the macro action after the long Easter weekend. A busy slate of data is on tap. The action gets started on Monday morning with three key reports. First up is the S&P Global US Manufacturing PMI report – the final read for March. This one shouldn’t be a big market mover since we already have a grasp on how manufacturing activity performed last month from S&P Global. The index rose to a 21-month high as of the latest reading amid healthy output and employment sub-indexes. Second, Construction Spending for February, while a lagged report, will be interesting since January marked the first sequential dip in building activity since December 2022. Third, all eyes will be on the ISM Manufacturing PMI report at 10:00 a.m. ET Monday – the market expects a 17th consecutive month of contraction (sub-50). As always, digging into the subcomponents – Employment, New Order, and Prices Paid – will be key.

The focus then shifts to the employment segment of the economy. After Factory Orders hit Tuesday morning, the February JOLTS report will be the first mover. Economists will surely inspect the quits rate and the ratio of job openings to available workers. The start of the month also features Total Vehicle Sales and other interim data from the auto OEMs. On Wednesday, the premarket features the ever-volatile ADP Employment report, expected to show a 155k private-market jobs gain. S&P Global Services PMI for March (final) comes after the opening bell – that index dropped to a 3-month low of 51.7 at last look which resulted in the Composite PMI easing off its February 8-month high. The ISM’s version of Services PMI is released shortly after, and a slight month-over-month increase is the consensus.

Thursday is somewhat quiet with Initial Jobless Claims, which continue to range between 200k and 240k, arriving at the usual time along with February Trade Balance figures. Friday is all about jobs. The report took on more importance after last month’s Fed meeting and press conference when Chair Powell remarked that he would be ready to support the labor market even if it meant lingering inflation. As it stands, economists expect a robust 216k nonfarm payrolls climb with 175k private jobs added last month. The unemployment rate is seen ticking down to 3.8% from 3.9% while average hourly earnings growth is expected to have accelerated to 0.3% amid no change in average weekly hours worked.

As for Fed Speak, Tuesday will be particularly active with Williams, Mester, and Daly all holding events that afternoon. Goolsbee speaks at midday on Thursday.

Big Week of PMI and Employment Data

Source: BofA Global Research

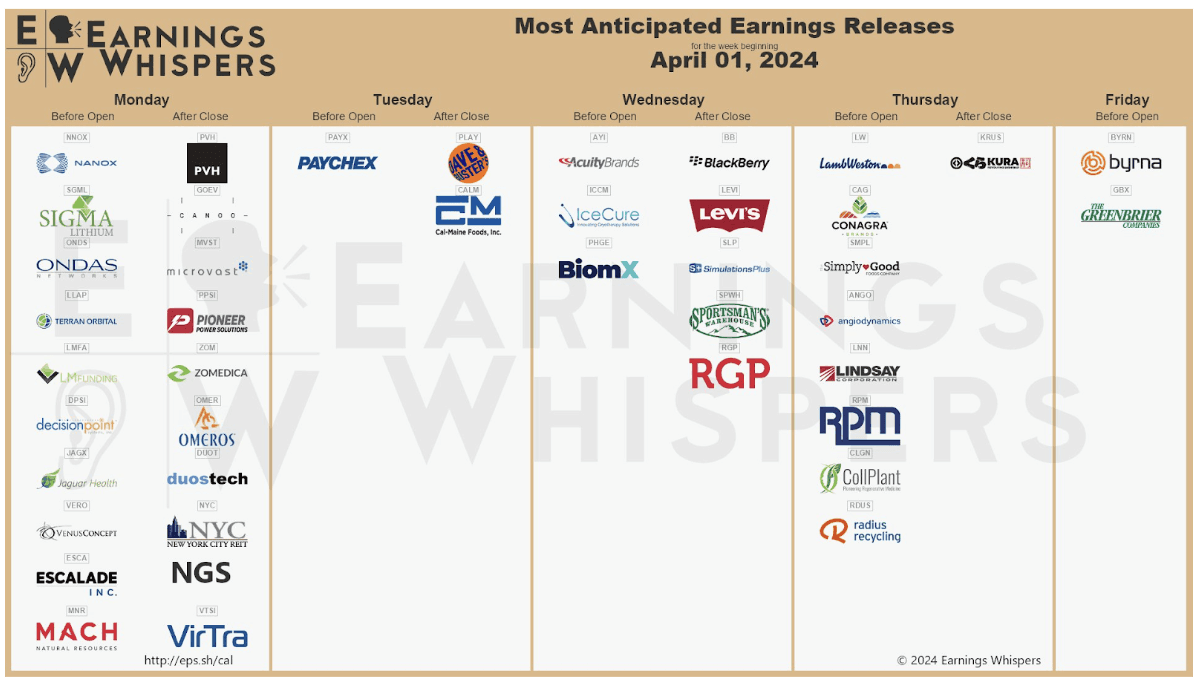

Earnings Reports This Week

The focus is on the macro with just a few significant companies issuing off-season quarterly reports. Just three S&P 500 firms are on the docket. The apparel company PVH Corp (PVH) posts profit numbers Monday night which may offer a quick refresh on the state of the higher-end consumer. Paychex (PAYX) and Dave & Buster’s (PLAY) report Tuesday, along with a timely post-Easter update from egg-producer Cal-Maine Foods (CALM). AcuityBrands (AYI), BlackBerry (BB), and Levi’s (LEVI) could be movers on Wednesday. Thursday morning’s reports from LambWeston (LW) and Conagra (CAG) may impact the Consumer Staples sector. The week is quiet after that pair of reports.

The Q1 earnings period gets underway unofficially on Friday, March 12 when some of the big banks post results. Factset shows an expected year-over-year EPS growth rate of 3.6%, which would be a third straight quarter of y/y EPS growth for the S&P 500. As companies aim to lower the earnings bar, there have been 79 negative guidance updates compared to just 33 positives. For FY 2024, the bottom-up consensus EPS figure has steadied near $244 (+10.6% yoy).

A Few Consumer Company Earnings Releases Highlight a Quiet Reporting Week

Source: Earnings Whispers

Topic of the Week: Three or Zero?

The PCE inflation data reported on Good Friday was good news for bulls worried about a significant uptick in inflation. The Core PCE price index rose 0.26% in February, leading to a large round-up in the reported figure – just a fraction weaker, and we’d be talking about a material miss. The annual rate is now 2.78%. That was below consensus but pretty much what Powell hinted at during his presser two weeks ago.

The Fed Chair continues to seek monthly PCE inflation rates significantly south of 30 basis points to ensure that the soft-landing narrative remains intact. There were very modest upward revisions to December and January’s PCE reports, but that didn’t cause a major spike in the year-on-year rate. Core Services ex-Shelter decelerated from a 0.66% January jump to just 0.18% in February. While annual core inflation eased to the lowest rate in three years, the hawks can point to a hook higher in the six-month annualized rate rising above 3.5% from under 2% at the end of last year.

Core PCE Declines Further Under 3%, Near-Term Annualized Measures Rise

Source: The Wall Street Journal

The Consumer Won’t Quit

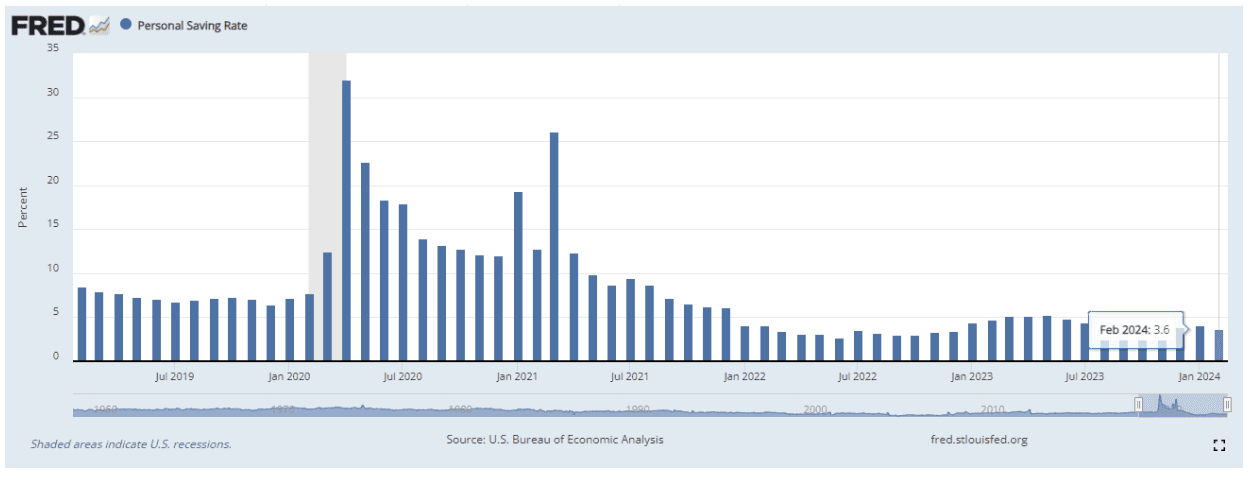

Flying a bit under the radar as both cash and futures were closed were data on Personal Income and Spending. The former increased less than expected while the latter smashed estimates. Outlays jumped 0.8% for February, three-tenths above the consensus forecast, with a robust 0.6% rise in real services spending. Notably, the US Personal Saving Rate fell to 3.6% - the lowest since December 2022.

US Personal Saving Rate Prints 15-Month Lows

Source: St. Louis Federal Reserve

Are We Still on for June?

The debate over Fed policy remains a hot one among economists and macro portfolio managers. Three cuts are priced into 2024, down from a peak of 6.5 late last year. There is a growing argument that no cuts may be the most probable outcome, assuming that inflation remains significantly above the 2% Fed goal and the job market continues to be healthy.

Consider that company profits are at record levels, corporate bond spreads are near cycle tights, and volatility in both the stock and bond markets are at or near multi-year lows. There are few signs of macro stress that should warrant an aggressive easing cycle. Despite that emerging view, Powell appears poised to cut before long, even if inflation stays a bit hot.

Inflation Bears Watching, Commodities Turn Higher

We’ve already seen market gauges of expected inflation tick up. Both the forward breakeven rates and inflation swaps have risen, though not dramatically so. Likewise, commodity prices bear monitoring as the barrel of oil and the cost of a gallon of gas creep higher. Agricultural commodities, in particular, are bulled up with the Invesco DB Agriculture ETF (DBA) surging to its highest level in almost a decade. Broadly, history shows that policy rate cuts outside of recessions can lead to further rises in raw material prices.

Ag Commodities on a Heater So Far in 2024

Source: Stockcharts.com

Rate Cuts Outside of Recessions Can Spell Higher Commodity Prices

Source: Goldman Sachs

PCE Data Counters February’s Disappointing Retail Sales Report

Given last Friday’s February spending data, the most recent Retail Sales report notwithstanding, the consumer seems to be aggressive enough. This actually creates a potentially significant tailwind for equities – improving macro data, an impending fall in short-term rates, $6 trillion-plus of cash on the sidelines, and a Fed that is apparently relaxed in hitting its 2% inflation target. But with the SPX now trading a whisker under 21 times forward earnings, clearly optimism is baked in to an extent.

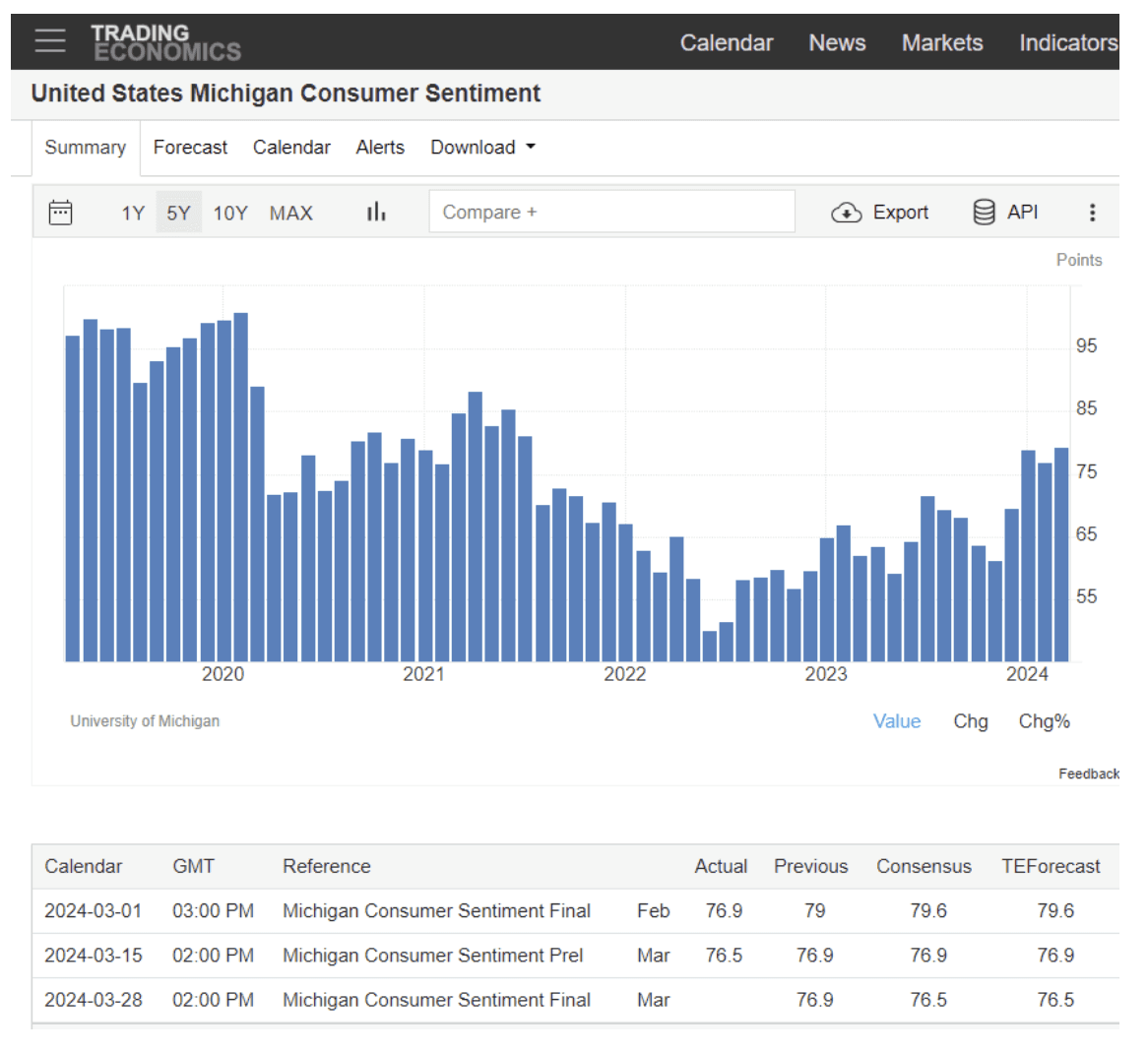

High Times in Stocks – And Sentiment

And we see optimism among consumers, too. While The Conference Board’s Consumer Confidence Index was unimpressive, with a muted expectations view, last Thursday’s revised March University of Michigan Surveys of Consumer Sentiment report revealed an upbeat take among respondents.

At 79.4, up about 3 handles from the preliminary reading, sentiment was the highest since July 2021. Expectations edged up, too, while the Current Conditions subindex increased to 82.5. It was a Goldilocks set of soft data considering that inflation expectations for the year ahead dropped to 2.9% from 3% while the 5-year inflation outlook dipped to 2.8%.

Are the Good Vibes Back Again? UMich Sentiment Jumps.

Source: Trading Economics

Q4 GDP Revised Higher

More good news came last Thursday in the form of upwardly revised Q4 GDP figures. The US economy is now seen as having expanded at a 3.4% annual pace late last year while the quarterly PCE Price Index was updated to just 2.0% from 2.1%. Consumption was revised higher, too, while the GDP Price Index held at 1.6%. Once again, the theme was higher growth, solid spending, and in-check inflation when looking in the rearview.

Big US Economic Growth in the Second Half of 2023

Source: Trading Economics

The Bottom Line

With the VIX hovering near 30 and the Treasury volatility index printing fresh 26-month lows, the stock and bond markets are about as sanguine as they have been since the boom of late 2021. Commodities have been on the rise, however, and jumpy prices for raw materials could be a harbinger of sticky inflation over the coming months. But with a seemingly dovish Fed, robust earnings, and upbeat consumers, the macro tailwinds are many as we hop into Q2.

Want access to your own expert-managed investment portfolio? Download Allio in the app store today!