Updated November 25, 2024

Inflation Exposed: Understanding How Inflation Impacts Your Portfolio and What to Do About It

Inflation Exposed: Understanding How Inflation Impacts Your Portfolio and What to Do About It

Inflation Exposed: Understanding How Inflation Impacts Your Portfolio and What to Do About It

AJ Giannone, CFA

The Macroscope

Inflation is one of those buzzwords that’s been dominating financial headlines for the past few years, and it’s more than just a news story—it's something that affects your purchasing power, your lifestyle, and your investments. But inflation isn’t one-dimensional. To understand how it truly impacts your portfolio, it's critical to understand three key forms of inflation: realized inflation, inflation expectations, and breakeven inflation.

Let's drill down and look at how different types of assets react to each, as well as how you can position your portfolio to be resilient in the face of some different types of inflation shocks.

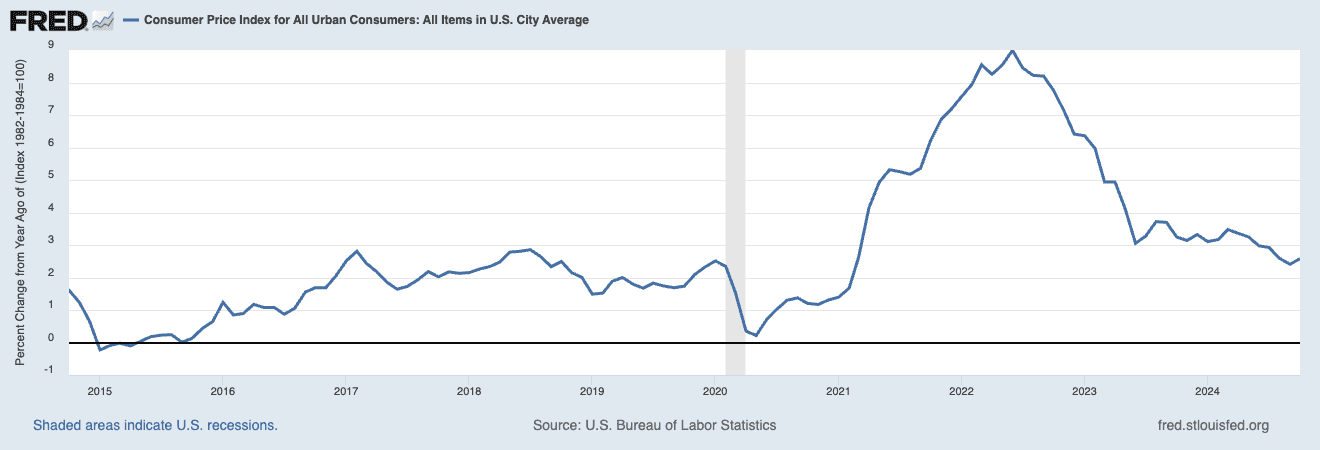

Realized Inflation: What It Is and How It Affects You

Realized inflation is what has already happened. It’s the kind of inflation you’ve noticed at the gas pump or grocery store. The government reports this figure through data like the Consumer Price Index (CPI). When realized inflation is high, your dollars buy less than they used to.

Different assets react differently to realized inflation. For example:

Commodities (like oil and gold) tend to perform well in periods of high realized inflation. Gold is often seen as a hedge against inflation because its value isn't tied directly to any currency.

Fixed income investments (such as bonds) usually struggle. When inflation erodes the purchasing power of future cash flows, bond prices can drop, especially if interest rates rise in response.

Equities can be a mixed bag—companies with strong pricing power (like consumer staples or utilities) tend to perform better, as they can pass higher costs on to consumers.

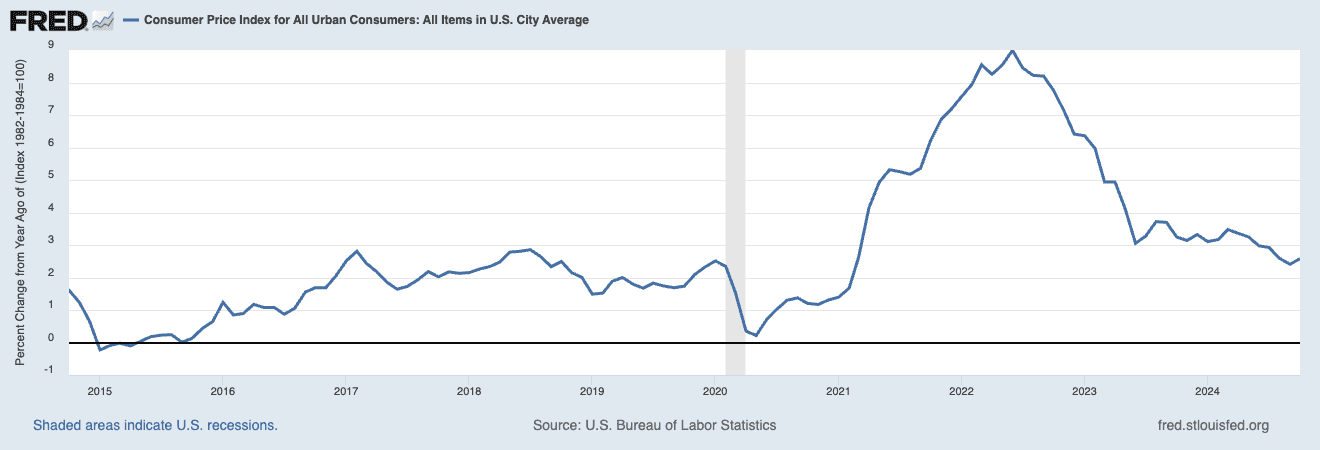

Figure 1 - Consumer Price Index (Year over year percentage change)

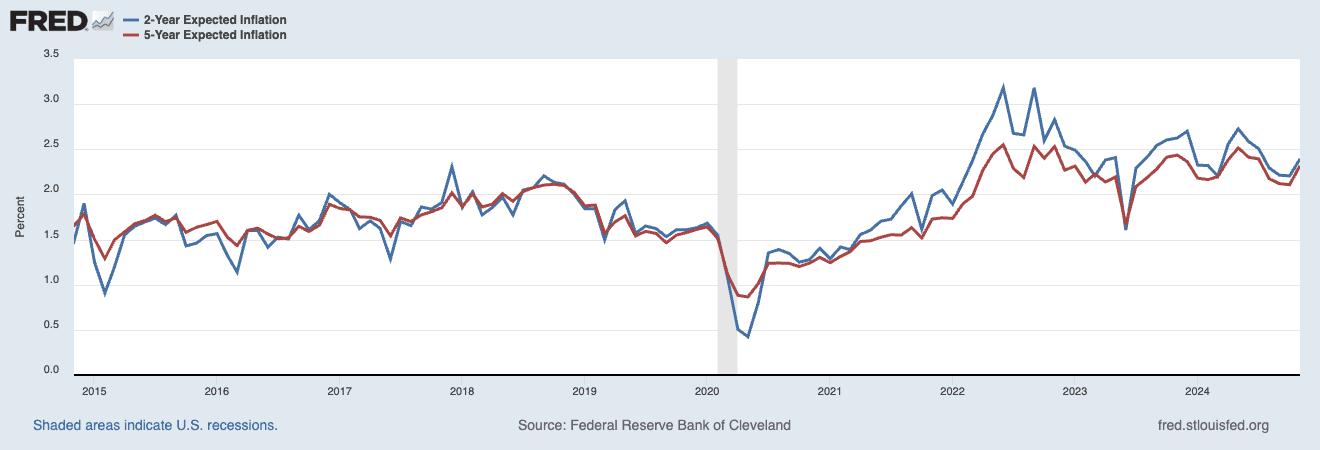

Inflation Expectations: The Market's View of the Future

Inflation expectations are what the market or economic participants anticipate inflation will be in the future. This is more abstract but just as crucial, especially for long-term investors.

Market expectations of inflation can heavily influence asset pricing. If investors expect inflation to rise, they may demand higher yields for long-term bonds, pushing down bond prices. This is particularly impactful for long-duration assets, such as technology or growth stocks, which derive a significant portion of their value from cash flows expected far into the future. In a discounted cash flow (DCF) valuation framework, higher inflation expectations increase discount rates, which lowers the present value of these future cash flows, thereby reducing the value of long-duration assets like long term bonds and growth stocks. Notably, inflation expectations can influence asset prices even in the absence of changes in realized inflation, as market sentiment and future projections shift valuations independently of current inflation data.

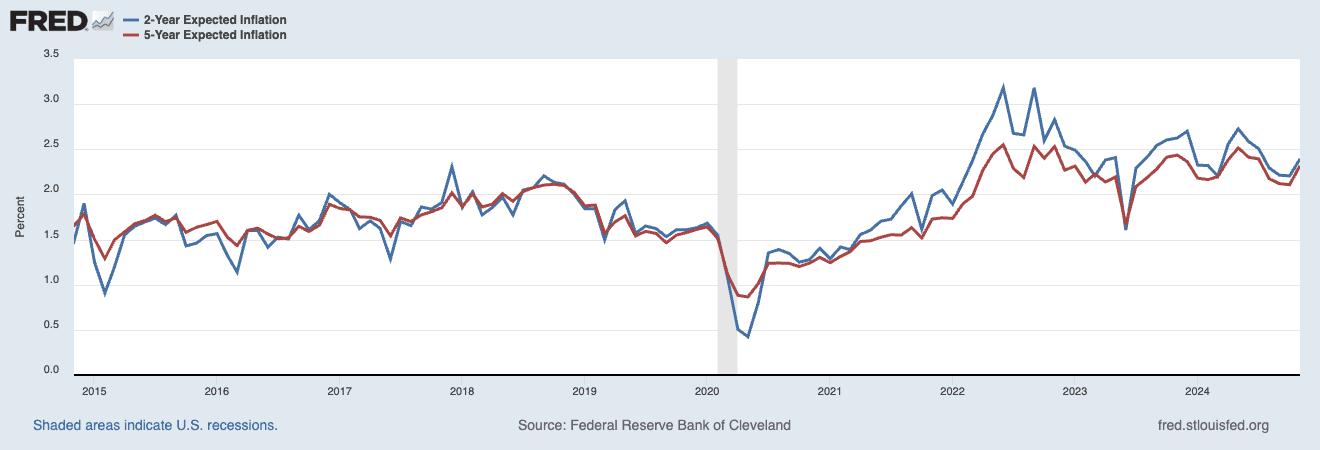

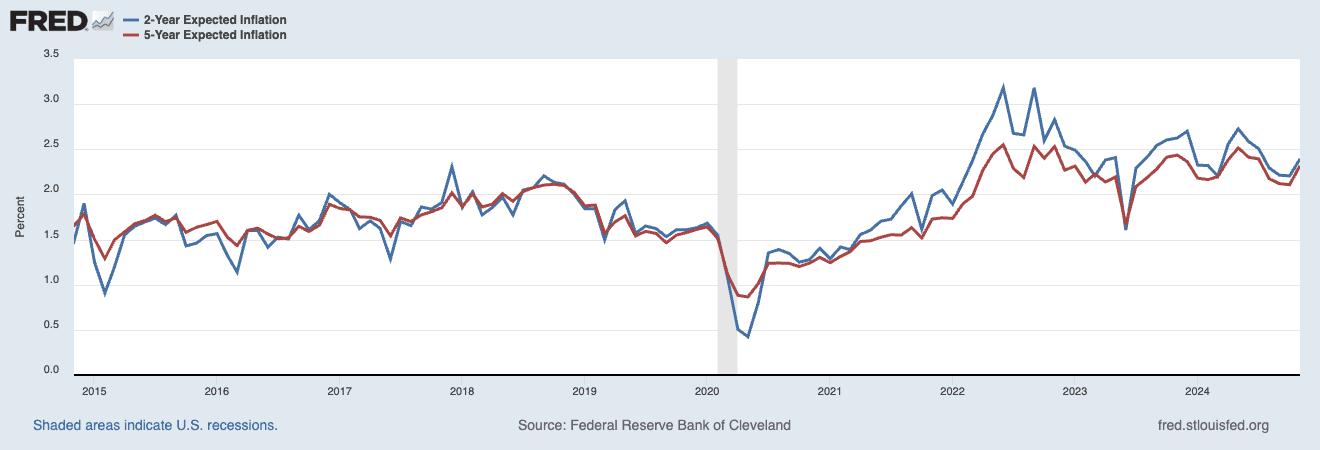

Figure 2 - 2 and 5 Year Expected Inflation (Year over year percentage change)

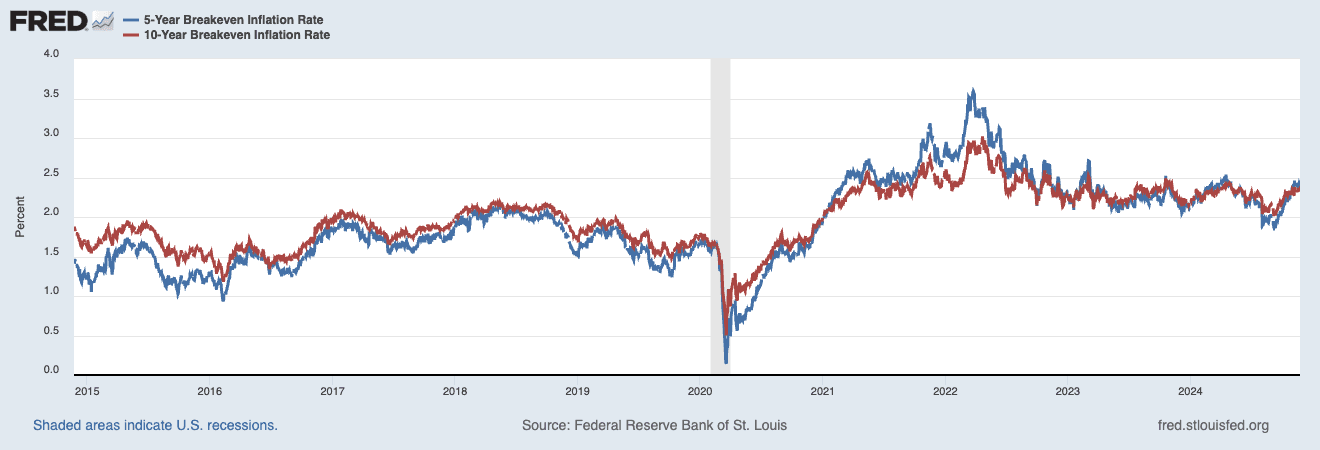

Breakeven Inflation: The Middle Ground

Breakeven inflation is the difference between the yield on a nominal Treasury bond and an inflation-protected Treasury (TIPS) of the same maturity. It provides insight into what the market expects in terms of inflation over a given period. TIPS perform differently based on realized inflation versus changes in inflation expectations. When realized inflation increases, TIPS adjust their payouts accordingly, providing a hedge against the actual loss of purchasing power. However, changes in inflation expectations can also influence TIPS performance indirectly, as rising expectations can increase the demand for TIPS even before inflation materializes, leading to an increase in their market price. Thus, TIPS can react positively to both rising realized inflation and growing inflation expectations, though the mechanisms differ in terms of magnitude and timing.

If breakeven inflation is rising, it can indicate that investors see a greater chance of inflationary pressures in the future. TIPS tend to perform well under such conditions, as they adjust their payouts based on realized inflation, offering a direct hedge. However, a key risk in an inflationary scenario is that interest rates often rise, which can reduce the prices of TIPS bonds, all else equal. This means that in practice, TIPS often perform relatively better as a hedge against increasing inflation expectations rather than against sudden shocks to realized inflation.

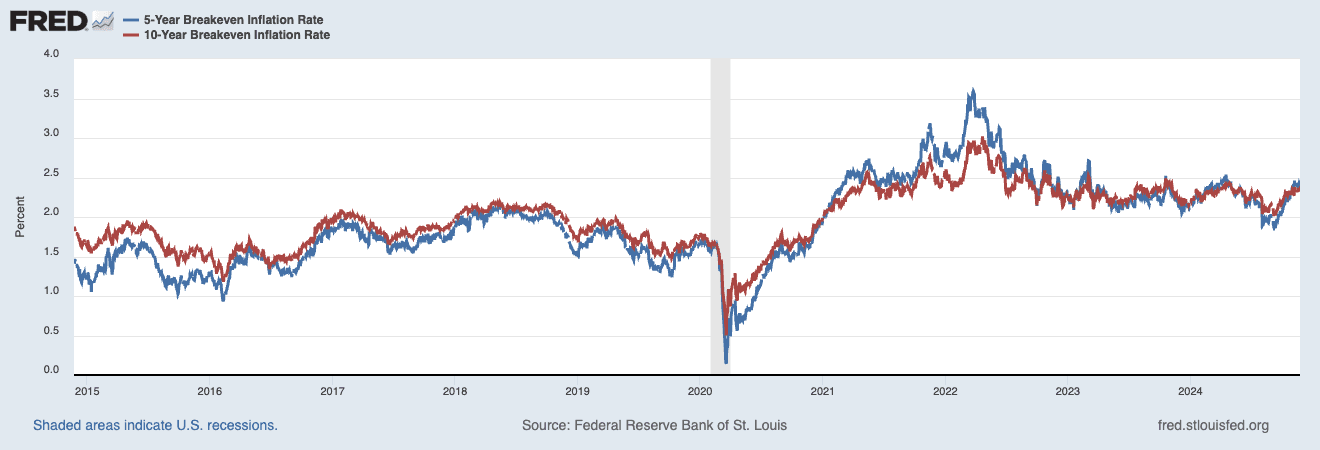

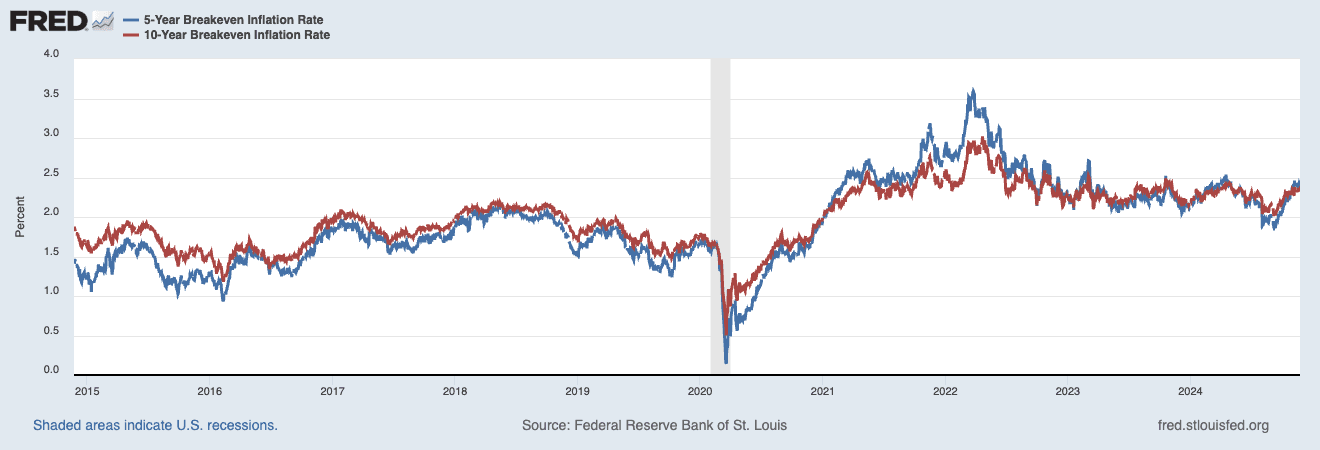

Figure 3 - 5 & 10 Year Breakeven Inflation Rate (Year over year percentage change)

Positioning Your Portfolio to Withstand Inflation

Inflation, no matter its form, poses challenges, but also opportunities for your portfolio. Here are some practical steps to consider to make your portfolio resilient:

1. Diversify with Inflation-Resilient Assets: Consider assets like commodities, real estate, and Treasury Inflation-Protected Securities (TIPS). These investments tend to fare better when inflation accelerates.

2. Focus on Equities with Pricing Power: Look for companies in sectors that can pass rising costs onto consumers. Consumer staples, healthcare, and utilities are often well-positioned here.

3. Consider Shorter-Duration Bonds: Longer-term bonds tend to suffer the most when inflation rises, as they lock in lower interest rates. Shorter-duration bonds or floating rate bonds can help protect your income from inflation shocks.

The 30,000 ft view

Understanding realized inflation, inflation expectations, and breakeven inflation can help you build a portfolio that’s ready to adapt, no matter what happens next. Inflation is a constant factor in the financial landscape, but by diversifying across asset classes that respond differently to inflation pressures, you can position yourself to manage risk and seize opportunities.

If you’re looking to put these lessons into practice, check out Allio Capital. We help investors navigate complex macroeconomic landscapes with insights and strategies designed to bolster your portfolio in all environments.

Inflation is one of those buzzwords that’s been dominating financial headlines for the past few years, and it’s more than just a news story—it's something that affects your purchasing power, your lifestyle, and your investments. But inflation isn’t one-dimensional. To understand how it truly impacts your portfolio, it's critical to understand three key forms of inflation: realized inflation, inflation expectations, and breakeven inflation.

Let's drill down and look at how different types of assets react to each, as well as how you can position your portfolio to be resilient in the face of some different types of inflation shocks.

Realized Inflation: What It Is and How It Affects You

Realized inflation is what has already happened. It’s the kind of inflation you’ve noticed at the gas pump or grocery store. The government reports this figure through data like the Consumer Price Index (CPI). When realized inflation is high, your dollars buy less than they used to.

Different assets react differently to realized inflation. For example:

Commodities (like oil and gold) tend to perform well in periods of high realized inflation. Gold is often seen as a hedge against inflation because its value isn't tied directly to any currency.

Fixed income investments (such as bonds) usually struggle. When inflation erodes the purchasing power of future cash flows, bond prices can drop, especially if interest rates rise in response.

Equities can be a mixed bag—companies with strong pricing power (like consumer staples or utilities) tend to perform better, as they can pass higher costs on to consumers.

Figure 1 - Consumer Price Index (Year over year percentage change)

Inflation Expectations: The Market's View of the Future

Inflation expectations are what the market or economic participants anticipate inflation will be in the future. This is more abstract but just as crucial, especially for long-term investors.

Market expectations of inflation can heavily influence asset pricing. If investors expect inflation to rise, they may demand higher yields for long-term bonds, pushing down bond prices. This is particularly impactful for long-duration assets, such as technology or growth stocks, which derive a significant portion of their value from cash flows expected far into the future. In a discounted cash flow (DCF) valuation framework, higher inflation expectations increase discount rates, which lowers the present value of these future cash flows, thereby reducing the value of long-duration assets like long term bonds and growth stocks. Notably, inflation expectations can influence asset prices even in the absence of changes in realized inflation, as market sentiment and future projections shift valuations independently of current inflation data.

Figure 2 - 2 and 5 Year Expected Inflation (Year over year percentage change)

Breakeven Inflation: The Middle Ground

Breakeven inflation is the difference between the yield on a nominal Treasury bond and an inflation-protected Treasury (TIPS) of the same maturity. It provides insight into what the market expects in terms of inflation over a given period. TIPS perform differently based on realized inflation versus changes in inflation expectations. When realized inflation increases, TIPS adjust their payouts accordingly, providing a hedge against the actual loss of purchasing power. However, changes in inflation expectations can also influence TIPS performance indirectly, as rising expectations can increase the demand for TIPS even before inflation materializes, leading to an increase in their market price. Thus, TIPS can react positively to both rising realized inflation and growing inflation expectations, though the mechanisms differ in terms of magnitude and timing.

If breakeven inflation is rising, it can indicate that investors see a greater chance of inflationary pressures in the future. TIPS tend to perform well under such conditions, as they adjust their payouts based on realized inflation, offering a direct hedge. However, a key risk in an inflationary scenario is that interest rates often rise, which can reduce the prices of TIPS bonds, all else equal. This means that in practice, TIPS often perform relatively better as a hedge against increasing inflation expectations rather than against sudden shocks to realized inflation.

Figure 3 - 5 & 10 Year Breakeven Inflation Rate (Year over year percentage change)

Positioning Your Portfolio to Withstand Inflation

Inflation, no matter its form, poses challenges, but also opportunities for your portfolio. Here are some practical steps to consider to make your portfolio resilient:

1. Diversify with Inflation-Resilient Assets: Consider assets like commodities, real estate, and Treasury Inflation-Protected Securities (TIPS). These investments tend to fare better when inflation accelerates.

2. Focus on Equities with Pricing Power: Look for companies in sectors that can pass rising costs onto consumers. Consumer staples, healthcare, and utilities are often well-positioned here.

3. Consider Shorter-Duration Bonds: Longer-term bonds tend to suffer the most when inflation rises, as they lock in lower interest rates. Shorter-duration bonds or floating rate bonds can help protect your income from inflation shocks.

The 30,000 ft view

Understanding realized inflation, inflation expectations, and breakeven inflation can help you build a portfolio that’s ready to adapt, no matter what happens next. Inflation is a constant factor in the financial landscape, but by diversifying across asset classes that respond differently to inflation pressures, you can position yourself to manage risk and seize opportunities.

If you’re looking to put these lessons into practice, check out Allio Capital. We help investors navigate complex macroeconomic landscapes with insights and strategies designed to bolster your portfolio in all environments.

Inflation is one of those buzzwords that’s been dominating financial headlines for the past few years, and it’s more than just a news story—it's something that affects your purchasing power, your lifestyle, and your investments. But inflation isn’t one-dimensional. To understand how it truly impacts your portfolio, it's critical to understand three key forms of inflation: realized inflation, inflation expectations, and breakeven inflation.

Let's drill down and look at how different types of assets react to each, as well as how you can position your portfolio to be resilient in the face of some different types of inflation shocks.

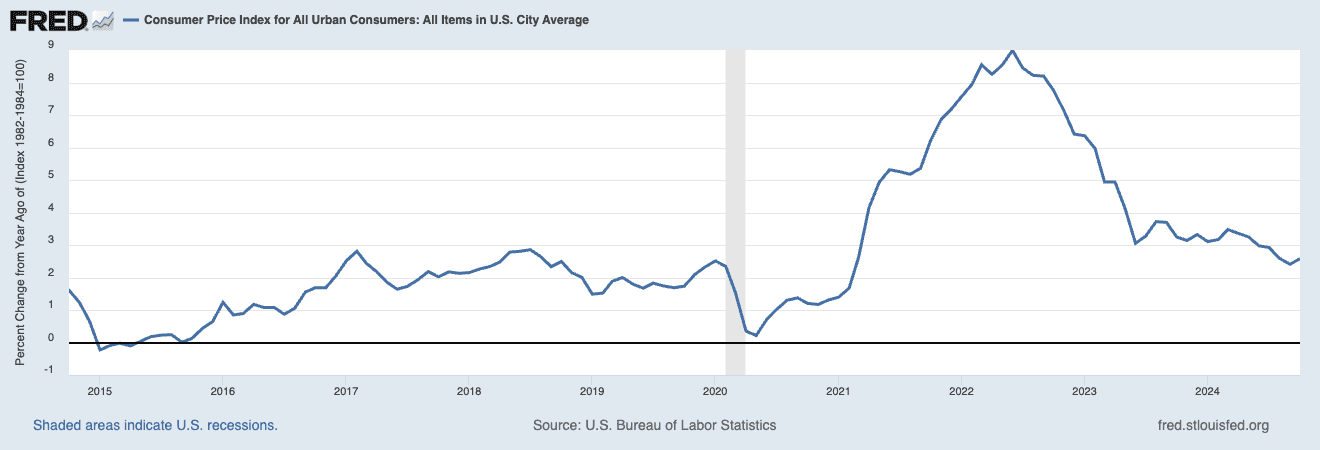

Realized Inflation: What It Is and How It Affects You

Realized inflation is what has already happened. It’s the kind of inflation you’ve noticed at the gas pump or grocery store. The government reports this figure through data like the Consumer Price Index (CPI). When realized inflation is high, your dollars buy less than they used to.

Different assets react differently to realized inflation. For example:

Commodities (like oil and gold) tend to perform well in periods of high realized inflation. Gold is often seen as a hedge against inflation because its value isn't tied directly to any currency.

Fixed income investments (such as bonds) usually struggle. When inflation erodes the purchasing power of future cash flows, bond prices can drop, especially if interest rates rise in response.

Equities can be a mixed bag—companies with strong pricing power (like consumer staples or utilities) tend to perform better, as they can pass higher costs on to consumers.

Figure 1 - Consumer Price Index (Year over year percentage change)

Inflation Expectations: The Market's View of the Future

Inflation expectations are what the market or economic participants anticipate inflation will be in the future. This is more abstract but just as crucial, especially for long-term investors.

Market expectations of inflation can heavily influence asset pricing. If investors expect inflation to rise, they may demand higher yields for long-term bonds, pushing down bond prices. This is particularly impactful for long-duration assets, such as technology or growth stocks, which derive a significant portion of their value from cash flows expected far into the future. In a discounted cash flow (DCF) valuation framework, higher inflation expectations increase discount rates, which lowers the present value of these future cash flows, thereby reducing the value of long-duration assets like long term bonds and growth stocks. Notably, inflation expectations can influence asset prices even in the absence of changes in realized inflation, as market sentiment and future projections shift valuations independently of current inflation data.

Figure 2 - 2 and 5 Year Expected Inflation (Year over year percentage change)

Breakeven Inflation: The Middle Ground

Breakeven inflation is the difference between the yield on a nominal Treasury bond and an inflation-protected Treasury (TIPS) of the same maturity. It provides insight into what the market expects in terms of inflation over a given period. TIPS perform differently based on realized inflation versus changes in inflation expectations. When realized inflation increases, TIPS adjust their payouts accordingly, providing a hedge against the actual loss of purchasing power. However, changes in inflation expectations can also influence TIPS performance indirectly, as rising expectations can increase the demand for TIPS even before inflation materializes, leading to an increase in their market price. Thus, TIPS can react positively to both rising realized inflation and growing inflation expectations, though the mechanisms differ in terms of magnitude and timing.

If breakeven inflation is rising, it can indicate that investors see a greater chance of inflationary pressures in the future. TIPS tend to perform well under such conditions, as they adjust their payouts based on realized inflation, offering a direct hedge. However, a key risk in an inflationary scenario is that interest rates often rise, which can reduce the prices of TIPS bonds, all else equal. This means that in practice, TIPS often perform relatively better as a hedge against increasing inflation expectations rather than against sudden shocks to realized inflation.

Figure 3 - 5 & 10 Year Breakeven Inflation Rate (Year over year percentage change)

Positioning Your Portfolio to Withstand Inflation

Inflation, no matter its form, poses challenges, but also opportunities for your portfolio. Here are some practical steps to consider to make your portfolio resilient:

1. Diversify with Inflation-Resilient Assets: Consider assets like commodities, real estate, and Treasury Inflation-Protected Securities (TIPS). These investments tend to fare better when inflation accelerates.

2. Focus on Equities with Pricing Power: Look for companies in sectors that can pass rising costs onto consumers. Consumer staples, healthcare, and utilities are often well-positioned here.

3. Consider Shorter-Duration Bonds: Longer-term bonds tend to suffer the most when inflation rises, as they lock in lower interest rates. Shorter-duration bonds or floating rate bonds can help protect your income from inflation shocks.

The 30,000 ft view

Understanding realized inflation, inflation expectations, and breakeven inflation can help you build a portfolio that’s ready to adapt, no matter what happens next. Inflation is a constant factor in the financial landscape, but by diversifying across asset classes that respond differently to inflation pressures, you can position yourself to manage risk and seize opportunities.

If you’re looking to put these lessons into practice, check out Allio Capital. We help investors navigate complex macroeconomic landscapes with insights and strategies designed to bolster your portfolio in all environments.

Related Articles

AJ Giannone, CFA

Diversification Across US and European Stock Markets in a Less Globalized World: What It Means for Investors Today

US vs. Europe stocks in 2025: Europe's early surge, but US remains "cradle of capitalism." Short-term gains vs. long-term growth. Dive into Allio's insights.

Joseph Gradante, Allio CEO

Trump vs Establishment: Using History as a Guide to Construct Your Portfolio

Trump's budget battle with Senate Republicans heats up as DOGE slashes federal spending. What it means for markets, inflation, and your portfolio.

Joseph Gradante, Allio CEO

The VIX, Market Cycles, and Ray Dalio’s Principles: Volatility Through a Macro Lens

The VIX isn't just a fear gauge—it’s a key to market cycles. Learn how Ray Dalio’s principles help investors navigate volatility, corrections, and bear markets.

AJ Giannone, CFA

Diversification Across US and European Stock Markets in a Less Globalized World: What It Means for Investors Today

US vs. Europe stocks in 2025: Europe's early surge, but US remains "cradle of capitalism." Short-term gains vs. long-term growth. Dive into Allio's insights.

Joseph Gradante, Allio CEO

Trump vs Establishment: Using History as a Guide to Construct Your Portfolio

Trump's budget battle with Senate Republicans heats up as DOGE slashes federal spending. What it means for markets, inflation, and your portfolio.

Disclosures

This material is for informational purposes only and should not be construed as financial, legal, or tax advice. You should consult your own financial, legal, and tax advisors before engaging in any transaction. Information, including hypothetical projections of finances, may not take into account taxes, commissions, or other factors which may significantly affect potential outcomes. This material should not be considered an offer or recommendation to buy or sell a security. While information and sources are believed to be accurate, Allio Capital does not guarantee the accuracy or completeness of any information or source provided herein and is under no obligation to update this information.

Past performance is not a guarantee or a reliable indicator of future results. All investments contain risk and may lose value. Performance could be volatile; an investment in a fund or an account may lose money.

There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest long-term, especially during periods of downturn in the market.

Disclosures

This material is for informational purposes only and should not be construed as financial, legal, or tax advice. You should consult your own financial, legal, and tax advisors before engaging in any transaction. Information, including hypothetical projections of finances, may not take into account taxes, commissions, or other factors which may significantly affect potential outcomes. This material should not be considered an offer or recommendation to buy or sell a security. While information and sources are believed to be accurate, Allio Capital does not guarantee the accuracy or completeness of any information or source provided herein and is under no obligation to update this information.

Past performance is not a guarantee or a reliable indicator of future results. All investments contain risk and may lose value. Performance could be volatile; an investment in a fund or an account may lose money.

There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest long-term, especially during periods of downturn in the market.

Disclosures

This material is for informational purposes only and should not be construed as financial, legal, or tax advice. You should consult your own financial, legal, and tax advisors before engaging in any transaction. Information, including hypothetical projections of finances, may not take into account taxes, commissions, or other factors which may significantly affect potential outcomes. This material should not be considered an offer or recommendation to buy or sell a security. While information and sources are believed to be accurate, Allio Capital does not guarantee the accuracy or completeness of any information or source provided herein and is under no obligation to update this information.

Past performance is not a guarantee or a reliable indicator of future results. All investments contain risk and may lose value. Performance could be volatile; an investment in a fund or an account may lose money.

There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest long-term, especially during periods of downturn in the market.

What We Do

What We Say

Who We Are

Legal

Allio Advisors LLC ("Allio") is an SEC registered investment advisor. By using this website, you accept our Terms of Use and our Privacy Policy. Allio's investment advisory services are available only to residents of the United States. Nothing on this website should be considered an offer, recommendation, solicitation of an offer, or advice to buy or sell any security. The information provided herein is for informational and general educational purposes only and is not investment or financial advice. Additionally, Allio does not provide tax advice and investors are encouraged to consult with their tax advisor. By law, we must provide investment advice that is in the best interest of our client. Please refer to Allio's ADV Part 2A Brochure for important additional information. Please see our Customer Relationship Summary.

Online trading has inherent risk due to system response, execution price, speed, liquidity, market data and access times that may vary due to market conditions, system performance, market volatility, size and type of order and other factors. An investor should understand these and additional risks before trading. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Past performance is no guarantee of future results.

Brokerage services will be provided to Allio clients through Allio Markets LLC, ("Allio Markets") SEC-registered broker-dealer and member FINRA/SIPC . Securities in your account protected up to $500,000. For details, please see www.sipc.org. Allio Advisors LLC and Allio Markets LLC are separate but affiliated companies.

Securities products are: Not FDIC insured · Not bank guaranteed · May lose value

Any investment , trade-related or brokerage questions shall be communicated to support@alliocapital.com

Please read Important Legal Disclosures

v1 01.20.2025

What We Do

What We Say

Who We Are

Legal

Allio Advisors LLC ("Allio") is an SEC registered investment advisor. By using this website, you accept our Terms of Service and our Privacy Policy. Allio's investment advisory services are available only to residents of the United States. Nothing on this website should be considered an offer, recommendation, solicitation of an offer, or advice to buy or sell any security. The information provided herein is for informational and general educational purposes only and is not investment or financial advice. Additionally, Allio does not provide tax advice and investors are encouraged to consult with their tax advisor. By law, we must provide investment advice that is in the best interest of our client. Please refer to Allio's ADV Part 2A Brochure for important additional information. Please see our Customer Relationship Summary.

Online trading has inherent risk due to system response, execution price, speed, liquidity, market data and access times that may vary due to market conditions, system performance, market volatility, size and type of order and other factors. An investor should understand these and additional risks before trading. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Past performance is no guarantee of future results.

Brokerage services will be provided to Allio clients through Allio Markets LLC, ("Allio Markets") SEC-registered broker-dealer and member FINRA/SIPC . Securities in your account protected up to $500,000. For details, please see www.sipc.org. Allio Advisors LLC and Allio Markets LLC are separate but affiliated companies. Allio Capital does not offer services to Florida.

Securities products are: Not FDIC insured · Not bank guaranteed · May lose value

Any investment , trade-related or brokerage questions shall be communicated to support@alliocapital.com

Please read Important Legal Disclosures

v1 01.20.2025

What We Do

What We Say

Who We Are

Legal

Allio Advisors LLC ("Allio") is an SEC registered investment advisor. By using this website, you accept our Terms of Service and our Privacy Policy. Allio's investment advisory services are available only to residents of the United States. Nothing on this website should be considered an offer, recommendation, solicitation of an offer, or advice to buy or sell any security. The information provided herein is for informational and general educational purposes only and is not investment or financial advice. Additionally, Allio does not provide tax advice and investors are encouraged to consult with their tax advisor. By law, we must provide investment advice that is in the best interest of our client. Please refer to Allio's ADV Part 2A Brochure for important additional information. Please see our Customer Relationship Summary.

Online trading has inherent risk due to system response, execution price, speed, liquidity, market data and access times that may vary due to market conditions, system performance, market volatility, size and type of order and other factors. An investor should understand these and additional risks before trading. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Past performance is no guarantee of future results.

Brokerage services will be provided to Allio clients through Allio Markets LLC, ("Allio Markets") SEC-registered broker-dealer and member FINRA/SIPC . Securities in your account protected up to $500,000. For details, please see www.sipc.org. Allio Advisors LLC and Allio Markets LLC are separate but affiliated companies. Allio Capital does not offer services to Florida.

Securities products are: Not FDIC insured · Not bank guaranteed · May lose value

Any investment , trade-related or brokerage questions shall be communicated to support@alliocapital.com

Please read Important Legal Disclosures

v1 01.20.2025