Updated January 8, 2024

Mike Zaccardi, CFA, CMT

Macro Money Monitor

Market Update

Stocks snapped their weekly winning streak with the S&P 500 losing 1.5%. It was a weak beginning to 2024, so bad that the widely discussed Santa Claus Rally turned negative. That’s a notoriously ominous sign for the year as a whole. One week at a time, though. Tech stocks took it on the chin during the holiday-shortened week with the Nasdaq Composite falling 3.2%, leading to its worst 6-day performance since the lows in October. Sector-wise, the defensive Healthcare and Utilities sectors each posted 2% gains while Information Technology was off 4.3%, driven lower by Apple (AAPL) which is down almost 10% from its all-time high notched in December.

What perhaps spooked equity investors was a jump in bond market yields. The rate on the 10-year Treasury note touched 3.8% late last year, helping to lift equities, but traders may be rethinking their collective outlook on Fed rate cuts over the next 12 months. The benchmark yield rose above 4% by the close on Friday. Selling in the fixed-income space hurt the rate-sensitive Real Estate sector – that group has been the leader off the October 27 market low. The TIPS ETF gave back two-thirds of a percentage point, and inflation expectations are between 2% and 2.3% across various maturities.

Oil prices rose late last week, helping to send commodities up by 1.3% to jumpstart 2024. Geopolitical jitters in the Red Sea supported the energy space, though a stronger dollar and a tick higher in interest rates were headwinds for other hard assets. Gold is off its high while the broad commodity index has been mired in a downtrend since a double-top technical pattern last September.

For the year, the S&P 500 is down 1.5% and the Nasdaq Composite is off 3.2%.

December 29, 2023 - January 5, 2024

The Look Ahead

It’s another busy week for December data following a mixed jobs report last Friday. Monday gets things going with NY Fed Consumer Inflation Expectations, a gauge the Fed pays close attention to. On Tuesday we’ll get the monthly Small Business Optimism Index – that report offers clues on hiring plans and expectations, helping to set the macro backdrop for the year. Trade numbers also come on Tuesday and Wednesday, which impact real GDP. The NY Fed’s John Williams speaks mid-week, shortly after a 10-year Treasury note auction.

The real action gets underway on Thursday. Another set of sanguine Jobless Claims is the consensus. At the same time, December CPI data strikes. Economists predict that last month’s consumer price rise was 0.3% at the Headline level while Core CPI is forecast to have climbed by just 0.2%, though that would be 0.1% higher than November’s change. An update on the Fed’s balance sheet as well as the US Federal Budget balance comes Thursday afternoon. Finally, wholesale price data hits on Friday in the PPI report. The National Association of Realtors’ Housing Affordability Index should show an improvement in home buying conditions given the drop in mortgage rates – we'll find out right before the 3-day weekend.

CPI & PPI Will Drive the Macro Narrative This Week

Source: Credit Agricole

Earnings Reports This Week

Fourth quarter corporate profit results start in earnest on Friday when a slew of large Financials-sector firms issue earnings. Before that, Jefferies (JEF) offers an early glimpse at the investment banking picture on Tuesday along with a handful of consumer and industrial companies. Wednesday is light but listen to what KB Home (KBH) says on Wednesday night given an uptick in mortgage applications lately.

Don’t expect fireworks on Thursday, but all eyes will be glued to what America’s biggest bank, JPMorgan Chase (JPM) posts on Friday morning including comments from CEO Jamie Dimon on the state of the economy and consumer. We’ll also hear from Bank of America (BAC) and its CEO Brian Moynihan as well as Wells Fargo (WFC), Blackrock (BLK), and Citi (C). UnitedHealth Group (UNH), the biggest weight in the Dow Jones Industrial Average, also reports Q4 earnings Friday morning. The JP Morgan Health Care Conference and the Consumer Electronics Show (CES) take place this week as well.

Big Banks Set to Kickoff Q4 Earnings Season

Source: Earnings Whispers

Topic of the Week: What Lies Beneath

On the surface, economic conditions appear pretty good. US real GDP growth was exceptionally resilient last year, easily running beyond what experts predicted in terms of overall demand. Then to start 2024, the Atlanta Fed’s GDPnow model shows yet another quarter of stronger-than-expected economic expansion. Inflation, meanwhile, is cooling at a steady pace – immaculately falling from a mid-2022 high above 9% annually to basically at the Fed’s 2% target, something we detailed last week. Companies keep on demanding jobs, evidenced by 36 consecutive months of payroll gains and an unemployment rate that has been under 4% for 23 straight months.

Could the economic tide be turning, though? It’s not just an exercise in hypotheticals. The December employment report, while robust in its headline 216k gain in net new jobs, was yet another in a series of concentrated labor market expansions. According to Goldman Sachs, which pulled data directly from the latest Bureau of Labor Statistics (BLS) surveys, recent hiring trends have been focused in three spots: Healthcare, Government, and Leisure & Hospitality.

Narrow Breadth in Employment Growth: Government and High-Touch Service Jobs in Demand

Source: Goldman Sachs

Want a Job? Uncle Sam is Hiring!

First, the Healthcare sector was constrained heavily by the effects of Covid – as demand for hospital services and other care skyrocketed, the supply of workers to meet that need was not there. The sector has been working through that imbalance for years on end. Next, it's intuitive why growth in the Government worker pool is not exactly a bullish catalyst for the private-sector economy. Politics aside, a truly healthy employment landscape would be one in which cyclical and growth-oriented industries are enjoying the most fundamental demand and have access to a qualified pool of talent.

Finally, Leisure & Hospitality was perhaps hit hardest by the pandemic, with high-touch services jobs going by the wayside as folks fled the perils of Covid. Then after trillions of dollars of fiscal stimulus was thrown at the system in 2020 and 2021, consumers like you and me have gradually shifted to preferring services over goods, exacerbating the need for labor in the services slice of the economy.

Wage Gains Solid, Other Metrics Troubling

As Goldman points out, back out those three areas of the monthly BLS survey, and the jobs market is essentially printing flat employment numbers. Within last Friday’s report, the details were not so sanguine either. The headline numbers were solid – there’s no argument there. Moreover, average hourly earnings topped estimates, coming in at +0.4% on a monthly basis, resulting in a year-over-year wage increase of 4.1%, 0.2% percentage point higher than the consensus forecast. Where we find potential trouble from a growth standpoint is in average weekly hours worked, the labor force participation rate, previous months’ revisions, and the always-volatile household survey.

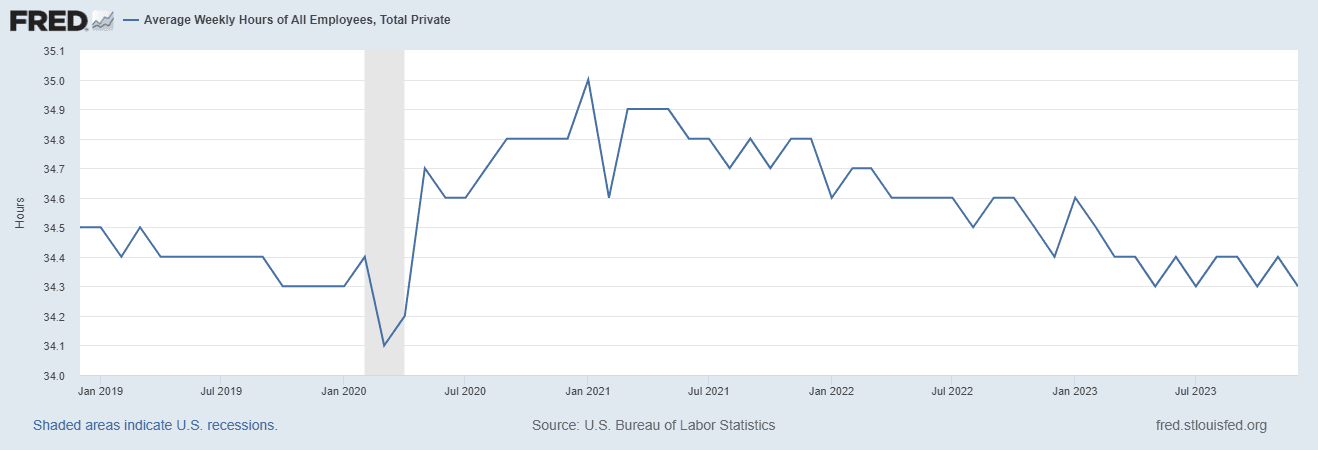

Ebbing Hours Worked

In the moments after the numbers crossed the wires, few pundits pointed to the hours worked data for November. At 34.3 hours per worker, it ties for the weakest print since Q2 2020. To be fair, it has bounced between 34.3 and 34.4 since last March, but each one-tenth of an hour represents an equivalent of about 300k jobs, according to Professor Jeremy Siegel. After peaking at 35.0 three years ago, this is a metric to watch in 2024 for clues on the underlying health of the labor market.

US Average Weekly Hours Worked: Testing Cycle Lows

Source: St. Louis Federal Reserve

Has the Prime-Age LFPR Peaked?

Another emerging cautionary trend is seen in the prime-age labor force participation rate. In general, a high and rising participation rate, particularly among the age 25 to 54 slice of the population, is considered positive as it signals that there’s capacity for the economy to grow as more folks contribute to the production of goods and services. Additionally, prime-age workers are often more productive than other segments of the labor pool. It is becoming clearer that this vital sign peaked from June through September last year. At 83.2%, it’s the weakest percentage since February last year.

Labor Force Participation Rate Among Prime-Age Workers: Flat to Down from Last Summer

Source: St. Louis Federal Reserve

Last Year’s Jobs Gains Partially Erased

Maybe the most obvious doubtful data trend is the sharply negative turn in total payroll revisions. The biggest bears and anti-establishment crowd are quick to highlight that the BLS has lowered previous months’ headline NFP gains in all but one month dating back to late 2022. In total, 443k jobs were wiped away last year (so far) simply due to re-figuring of the employment situation. Critics may assert that there are political motivations at play, but no matter how you slice it, the jobs market is not as strong as is being reported at first blush. A fundamental reason for this could be a lower response rate to the BLS’s surveys – the monthly JOLTS report has been troubled by a lack of willing participants.

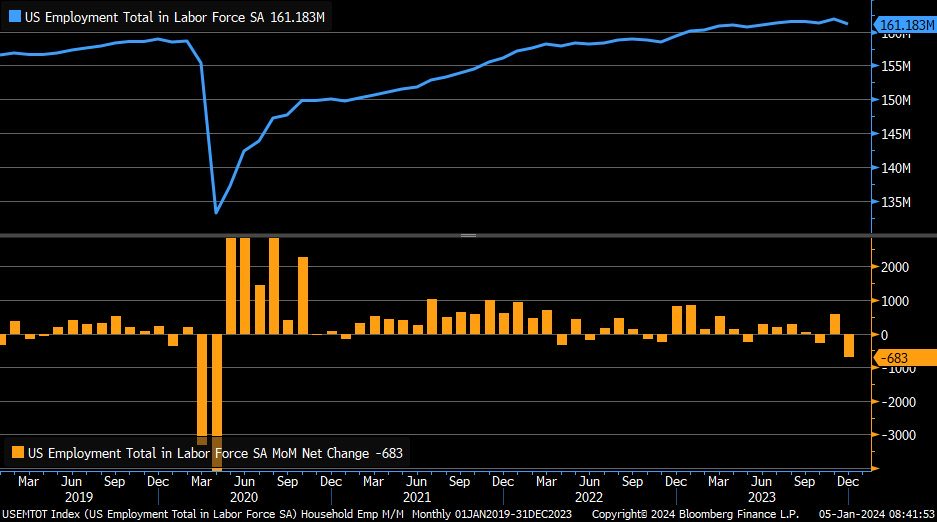

Household Survey Reveals Weakness

Finally, and this one comes with a large grain of salt, the household survey, used to calculate the unemployment rate, took a major December dip. That gauge of employment fell by a whopping 683k jobs, the most since April 2020. It’s totally normal to see the household survey whip around by hundreds of thousands of jobs purportedly gained or lost each month, but December’s drop was concerning.

A Massive Drop in Employment, According to the Volatile Household Survey

Source: Liz Ann Sonders, Schwab, Bloomberg Data

Policy Implications

Those are some of the lowlights from last month’s labor market report. Of course, it was not all bad. In net, workers are earning about 2% above the inflation rate, which helps to fuel discretionary spending and, despite all the calls for a recession, the official unemployment rate remains not all that far from multi-decade lows. Nevertheless, the Fed will continue to have eyes on the health of the jobs situation as the year unfolds.

Does the Fed See Something We Are All Missing?

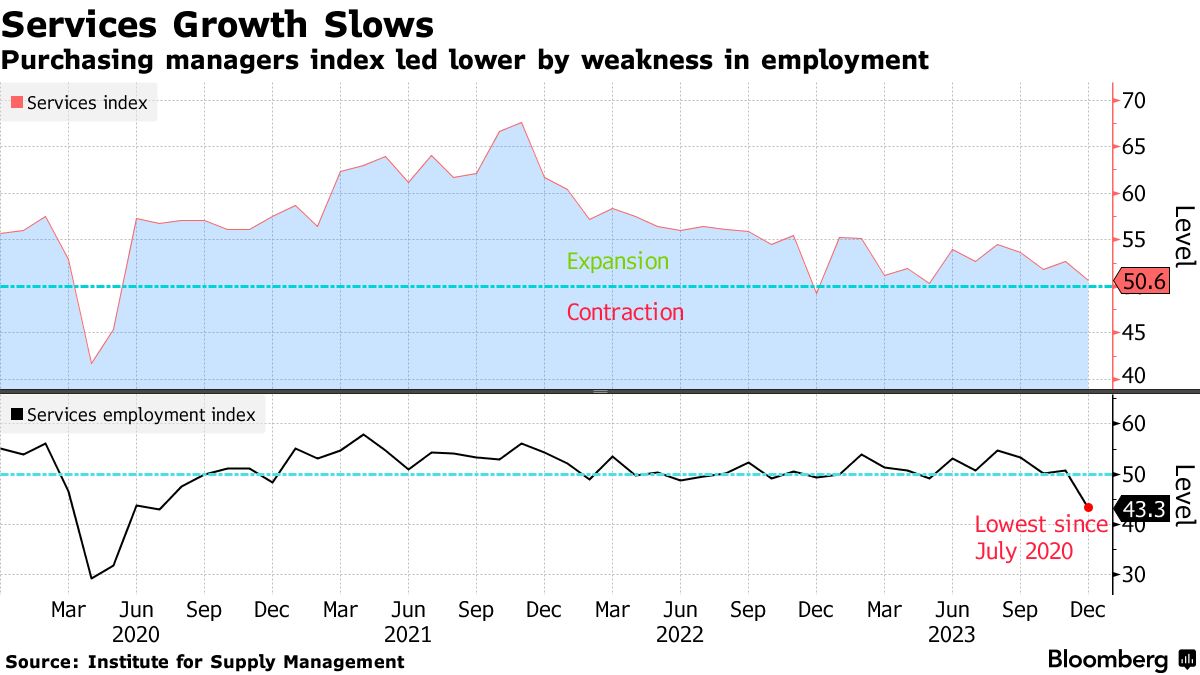

Speaking of the Fed, in light of what could be a softening labor market (underscored by a very weak ISM Services Employment subindex reading released last Friday, too) do policymakers see something investors may be missing? This is a key theme we are going to track over the coming weeks, ahead of the February and March FOMC gatherings. Chair Powell and the rest of the committee have a tricky balancing act to pull off during this election year.

December ISM Service's Employment: Lowest Since July 2020

Source: Bloomberg

Yes, they have plenty of bullets to shoot at recession risks given that the Effective Fed Funds Rate is at a lofty 5.33%, but clearly the policy rate may not have the firepower it possessed in previous economic cycles. There’s no doubt that the Fed parses real-time data all the time, seeking leading indicators of what the macro environment may look like. It’s unlikely, however, that a major Fed put is on the table given the still-ample size of its balance sheet and lurking inflation risks.

The $34 Trillion Mark

On the fiscal side of the ledger, you may have seen that the national debt crossed $34 trillion just before the ball dropped in Times Square. That is yet another hot topic to be debated as the Iowa Caucuses get underway next week.

The Bottom Line

Stocks stumbled out of the 2024 gates, but the losses were not severe. Perhaps it was to be expected following a remarkable rally from the lows in October. Amid a jobs market that might not be all it's cracked up to be, policymakers will have their work cut out for them over the weeks and months ahead.

Want access to your own expert-managed investment portfolio? Download Allio in the app store today!