Updated March 11, 2024

Mike Zaccardi, CFA, CMT

Macro Money Monitor

Market Update

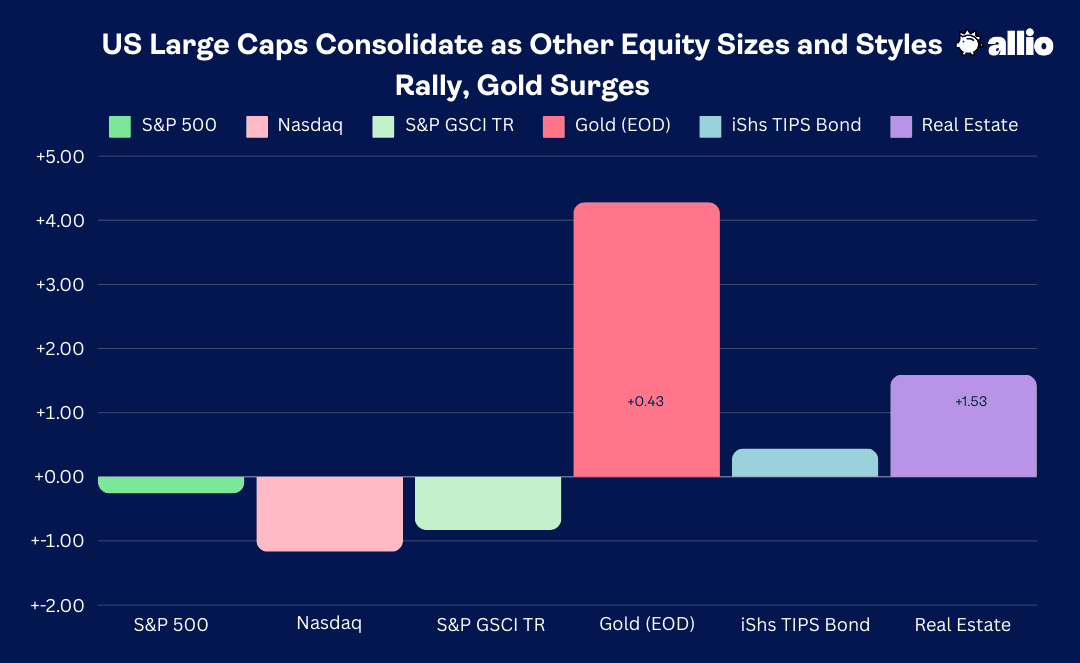

Stocks fell modestly last week as some Friday profit-taking brought the S&P 500 to just its third weekly loss in the past 19 weeks. It has been a remarkable rally off the October low, driven by AI euphoria. It was a small 0.3% loss for the SPX while the Nasdaq Composite fell by 1.2%. Zoom out, though, and you’ll find that plenty of areas managed to notch fresh two-year highs. The Russell 2000 index appears to be breaking out – the IWM ETF rose 0.5% last week. Foreign equities (VEU) jumped 1.3% - their best settle since March 2022. Finally, shares of value companies (VTV) rallied 0.8%.

Amid this apparent broadening out, the defensive Utilities sector boasted the biggest gain among the 11 S&P 500 groups – XLU was higher by 3.3%. Real Estate, Materials, and Energy each sported 1%+ advances. The tech trade was tepid, though. Communication Services, Information Technology, and the Consumer Discretionary sector (dominated by Amazon (AMZN) and Tesla (TSLA) were the only three sectors down on the week.

In the bond market, it was a busy week with Fed Chair Powell testifying on Capitol Hill, key productivity numbers crossing the wires, and of course the February employment report. By the time the dust settled on Friday, the 10-year Treasury yield was down 9 basis points from the previous week’s close. That helped lift the bond market to a modestly positive return, but the real winner was gold. The precious metal finished at an all-time high, firmly breaking out from a years-long consolidation area amid intense gold-buying by China’s central bank and US debt that’s rising at a pace of $1 trillion every 100 days. A weaker dollar was yet another macro tailwind for gold, but the broader commodity complex was slightly lower on the week.

For the year, the S&P 500 is up 7.4% and the Nasdaq Composite is higher by 7.2%.

Source: Stockcharts.com

The Look Ahead

A data-heavy week is on tap. Monday is quiet, but the macro action gets going in the dark and early hours at 6:00 a.m. EDT with the NFIB Small Business Optimism Index. While the vibes across Main Street and Wall Street have been on the mend, the NFIB gauge turned softer in January with labor quality and inflation cited as top concerns. After last week’s generally healthy employment figures, we’ll see if there’s a turnaround in the downbeat small business outlook that began the year.

The biggest report of the week hits at 8:30 a.m. on Tuesday. The February CPI report is seen as more important than usual considering that January’s inflation numbers were to the hot side, prompting economists to push out their predictions for the first Fed rate cut. Seasonal adjustments were seen as significant in the report released a month ago, but if we get another strong CPI print, that would likely bring about volatility in both the stock and bond markets.

Then we get a breather until an onslaught of key macro data comes out on Thursday morning. Initial Jobless Claims continue to range in a comfort zone between 200,000 and 240,000, so we’re steady as she goes there. Also released in the pre-market on the 14th are PPI numbers and February Advance Retail Sales. Amid “shrinkflation” criticism from President Biden, wholesale price trends have become increasingly market-moving since the middle of last year, so if Headline PPI verifies above the +0.3% consensus, that could spell bad news for equities. As for Retail Sales, expectations are actually high following January’s spending drop. Again, however, early-year seasonal tweaks to the data provided a cloudy image of the consumer in January.

Later in the day on Thursday and through Friday morning features more market-moving data points. Empire Manufacturing is forecast to have been weak in the New York region for March, which would be on par with so many soft manufacturing surveys of late. The Import Price Index will be yet another inflation clue. Then all eyes will focus on February Industrial Production data and a first look at March University of Michigan consumer sentiment tallies. Friday could see some added volatility as its triple witching day – the expiration of stock options, stock index futures, and stock index options. Lastly, the Fed is in its blackout period ahead of the March 20 FOMC decision.

CPI, PPI, Retail Sales, Industrial Production, UMich Are the Highlights

Source: BofA Global Research

Earnings Reports This Week

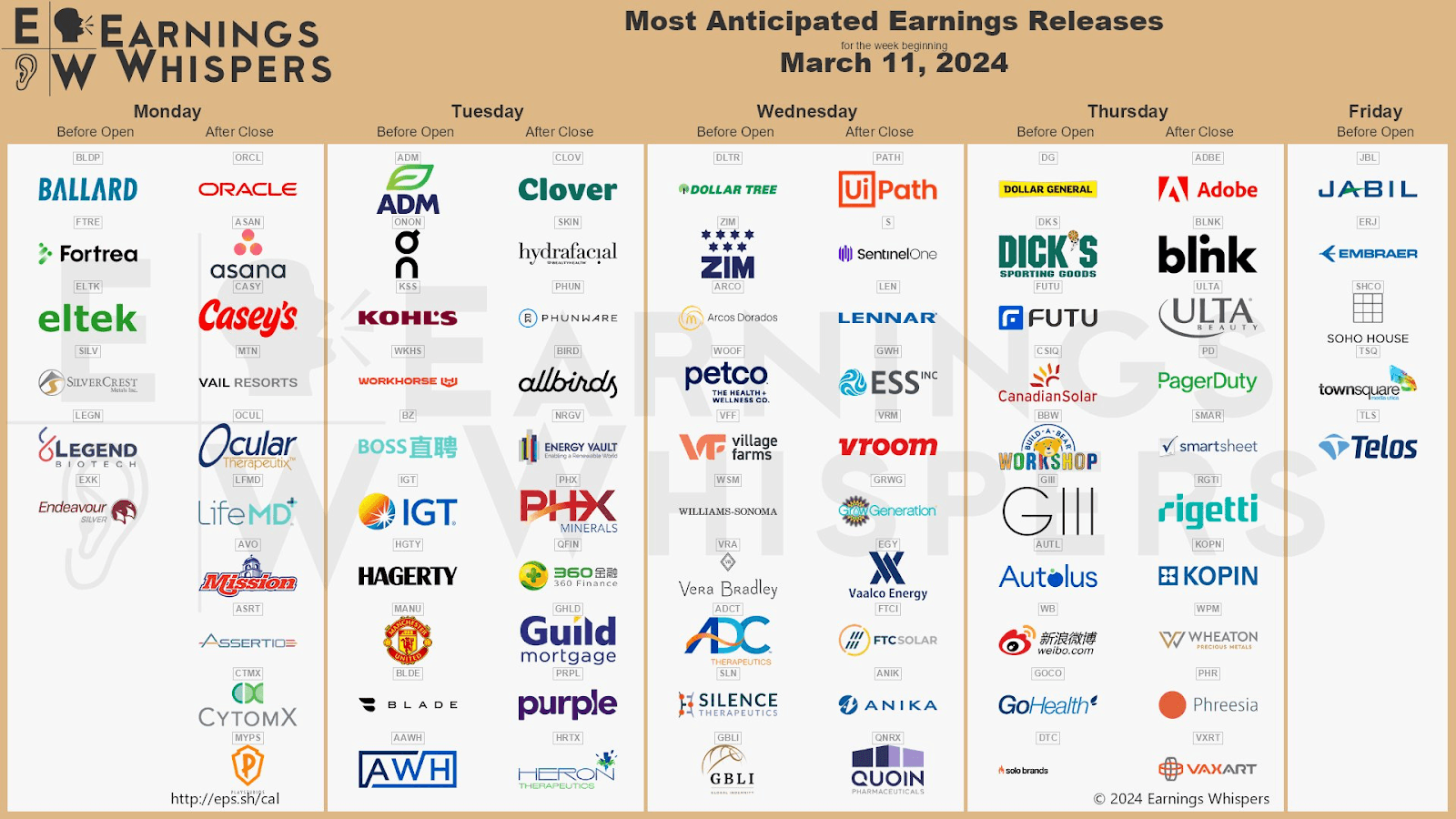

The focus will be on the macro over the coming days, but off-period earnings reports will be plentiful amid “Investor Day” season in the corporate event world. Oracle (ORCL) numbers will be the focus of post-market financial TV on Monday. ADM (ADM) from the Consumer Staples sector reports Tuesday morning along with another gauge of the consumer via Kohl’s (KSS) Q4 report. Low-end spending trends will be seen through Dollar Tree’s (DLTR) earnings release Wednesday before the bell. SentinelOne (S) in the cybersecurity space and homebuilder Lennar (LEN) report that evening. Dollar General (DG) and DICK’s (DKS) post profit numbers Thursday BMO before Adobe (ADBE), sure to mention AI, reports.

Big picture, a more favorable macro backdrop has resulted in a bump up in both 2024 and 2025 S&P 500 EPS outlooks. Bottom-up analysts now see $244 of current-year operating EPS and a $277 out-year total. Using forward 12-month estimates, the SPX now trades at a 20.7 multiple – the loftiest since January 2022.

Oracle, Adobe, and Small Consumer Companies Report This Week

Source: Earnings Whispers

Topic of the Week: Political Jostling and Jumpy Markets

It’s said that markets hate uncertainty. It's sort of like human nature – often the “not knowing” is more uneasy than actually receiving bad news. We feel this from time to time, perhaps waiting for that call from the doctor or in simpler instances, say, before a meeting at work. Human nature, of course, is a hallmark of how financial markets operate. The good news is that we kind of know what is coming down the pike, politically speaking.

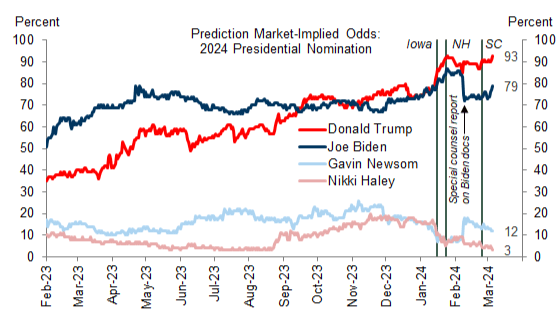

A Trump-Biden Rematch Is Nearly Sealed According to Betting Markets

Source: Goldman Sachs

Super-Dull Tuesday

Last week, former President Trump all but secured the GOP nomination. He will likely earn enough delegates over the coming days to officially become the presumptive Republican nominee. Betting markets are also firming up that President Biden will make it to election day despite the occasional mental lapse.

While prediction markets are split on who will win the presidency, we have a good sense of where both men stand on the issues. The former POTUS would no doubt be focused on prioritizing American companies and imposing more strict policies on China. The current Commander-In-Chief may look to further stimulate the low-end consumer as well as select industries, such as renewable energy.

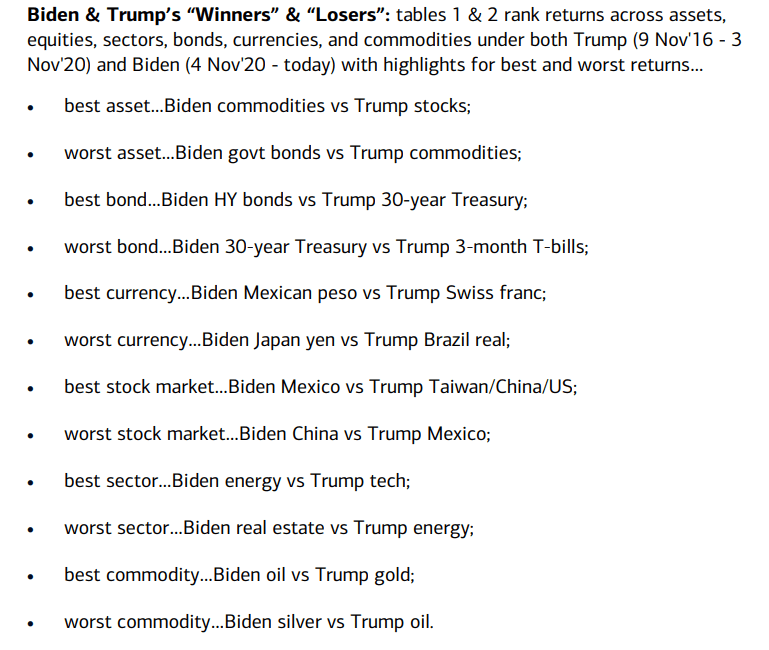

Markets Discount the News (and Political Rhetoric)

But price action does not always follow the script you might write based on their preferred ways of running the nation. Consider that under President Trump, commodities like coal performed terribly. And what might you guess were among the top-performing country stock markets from January 2017 to January 2021? Along with the US, China and Taiwan fared well. Sector-wise, Energy has actually been the top S&P 500 sector ETF since Joe Biden was sworn in as the 46th President despite all of his negative rhetoric toward big oil & gas companies.

Biden & Trump Winners & Losers –Michael Hartnett (BofA)

Source: BofA Global Research

Thinking like a Macro Investor

The point, from a macro and asset allocation perspective, is that investing often runs counter to what you think should happen. For now, everything has been coming up roses across the board in equities, perhaps partly because of the high amount of certainty we’ve had on the political front. As election day nears, that could change.

The focus now shifts to Misters Biden’s and Trump’s policies. During the State of the Union last week, President Biden proposed a 21% corporate minimum tax, up from the current 15% that was enacted in the Inflation Reduction Act (IRA), and limiting various tax breaks. Additionally, he wants to increase the overall corporate tax rate from 21% to 28%. He also aims to increase the tax on corporate buybacks, which is currently a paltry 1% and has not seemed to impact companies’ share-repurchase activities.

There remain eight long months ahead of us, and more drama will surely unfold.

US Companies Favor Buybacks Over Dividends, 1% Tax Notwithstanding

Source: BofA Global Research

From Trump & Biden to Powell

Shifting away from the political landscape and back toward traditional macro, traders were generally pleased with what Jay Powell had to say before the Senate Banking Committee last week. The main takeaway was that the Fed, despite some inflationary risks seen in February’s data, is on the path toward its first rate cut.

The key phrase from the Chair was that the FOMC Is “not far” from gaining enough confidence to bring down its policy rate. What does “not far” mean? Well, surely an ease is not on the table for the March meeting, but if we see a marked slowdown in CPI, PPI, and the PCE deflator this month and next, it’s possible that a quarter-point cut could come as soon as May. More likely, though, is that we will have to stand pat for June or July. Either way, markets are moving more on growth tailwinds and momentum than monetary policy changes and Fed Speak right now.

And growth looks solid. The Atlanta Fed’s GDPnow model is close to the Blue Chip Consensus Q1 expansion forecast – in the low to mid 2% zone. This comes after a strong second half of 2023 and what’s currently expected to be a trough in GDP growth in Q2 and Q3 2024. A soft landing remains probable. The latest data set confirming that conjecture was last Friday’s February jobs report.

US Real GDP Forecast

Source: Goldman Sachs

The Employment Picture Stays ‘Good, Not Great’

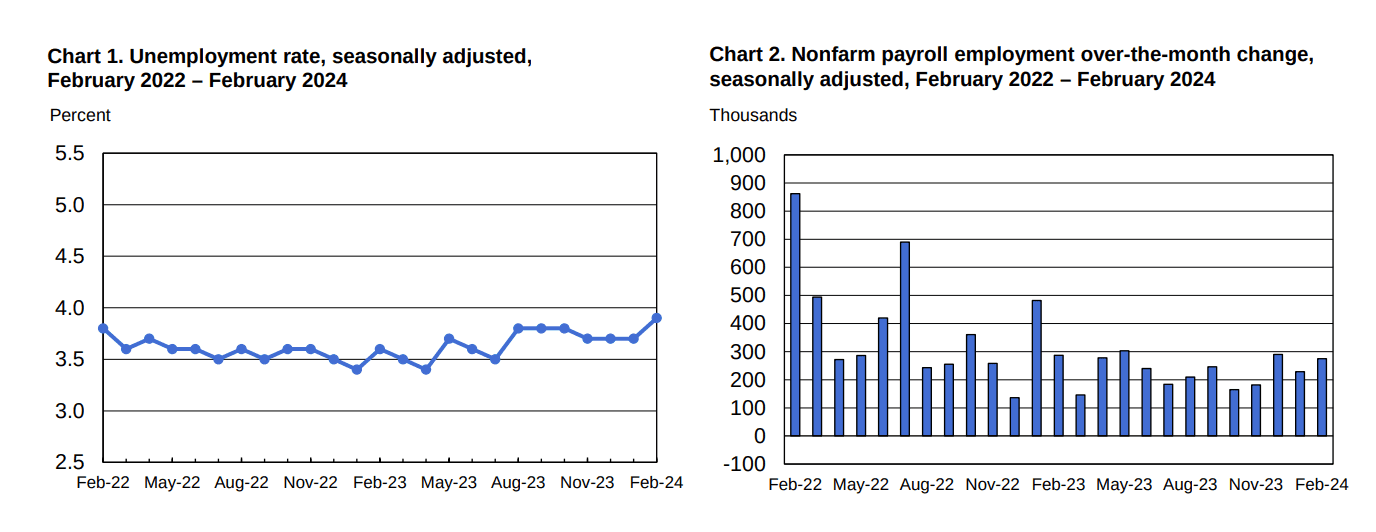

Payrolls for the previous month came in above forecasts. At +275,000, there’s little sign of material weakness in the labor market. Stock futures jumped initially on Friday morning, as downward revisions to both the December and January headline numbers helped to confirm that the start of the year was not as hot as first reported, but gains were given back by the afternoon.

What was encouraging within the release was that wage growth came in lighter than expected, helping to quell some inflation fears. And while the unemployment rate rose to 3.9%, that was mainly driven by an uptick in the jobless rate among workers age 18-24, a notoriously volatile segment of the workforce.

Unemployment Rate Creeps Higher in February, Jobs Growth Remains Decent

Source: BLS

Last Week’s Data Underscored Healthy Modest Growth

No warning flags were waved after the NFP report was digested. It came after ADP Employment, the January JOLTS survey, and initial claims all came in near expectations. A small bullish boost came via Nonfarm Productivity and Unit Labor Costs last Thursday. The latter showed just a 0.4% sequential increase, down from the previous estimate of +0.7%. That helped to send Treasury yields lower and risk-on areas of the stock market up.

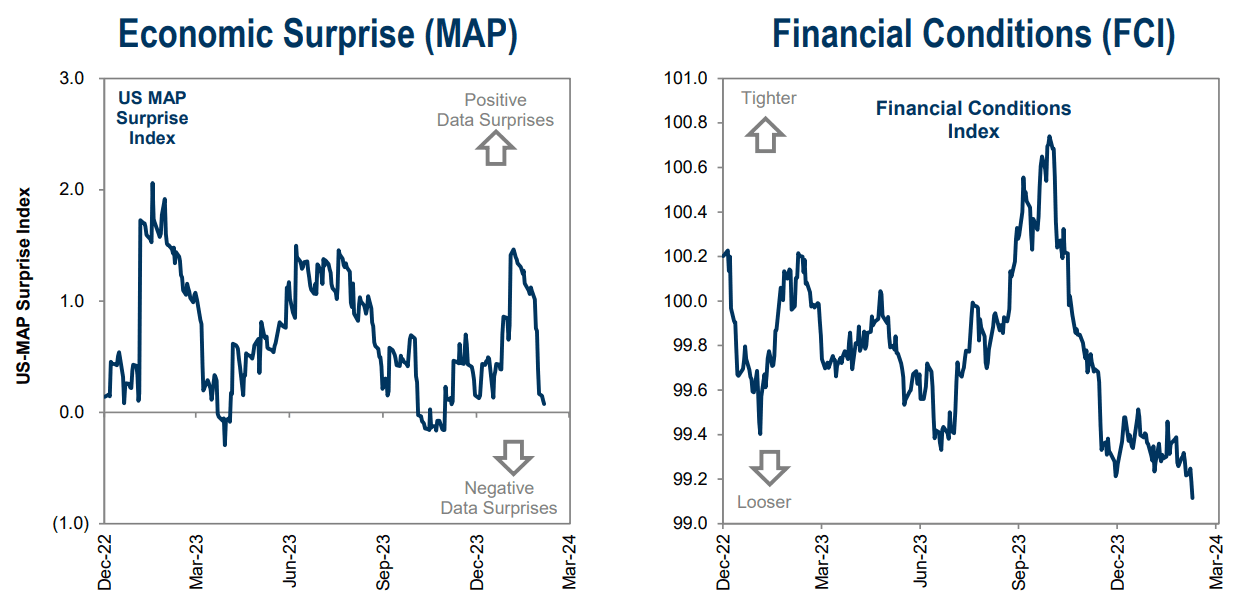

Big picture, financial conditions are now at the loosest levels of the cycle, feeding the high-momentum frenzy and crypto mania. While the IPO and SPAC windows remain shuttered, there are certainly shades of late 2021 in pockets of the investment universe.

Economic Surprises Turn South, Financial Conditions Loose

Source: Goldman Sachs

The Bottom Line

It was an active week on the macro front with key economic reports, Powell’s remarks before Congress, and plenty of political chatter. With some FOMO in the air as we approach the springtime, broader bull market participation is welcome news for diversified investors. Up 16 of the past 19 weeks, it has been a remarkable rally for US large caps as pundits keep searching for the next major risk.

Want access to your own expert-managed investment portfolio? Download Allio in the app store today!